Recession Model Update (March 2022)

Friends,

Just 2 quick updates for you: one on the model, and one on a useful but under-mentioned inflation forecasting tool.

Current Values (as of March 8, 2022)

24-Month Value Remains Elevated

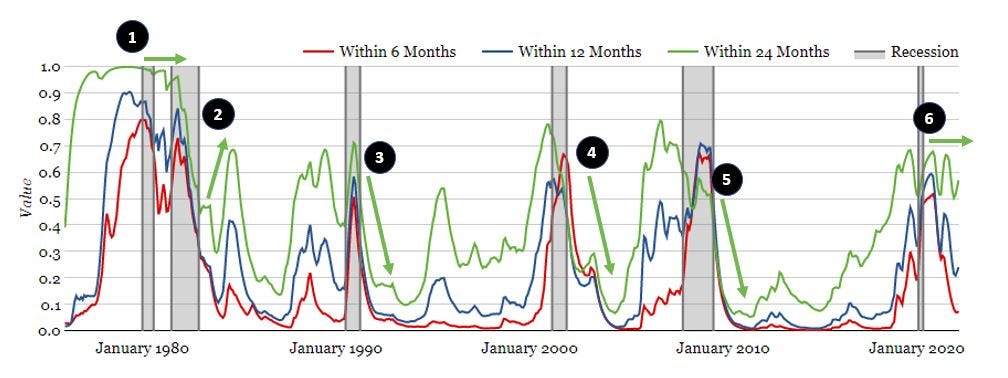

Immediately following a recession, the 24-month values (green line) tend to fall dramatically - see Points 3, 4, and 5 in the chart below.

However, in the aftermath of the 2020 recession, the 24-month values have not fallen dramatically (Point 6). This has happened twice before:

After the 1980 recession (Point 1). The Federal Reserve (Paul Volcker) raised interest rates to fight inflation, and the 1981-1982 recession followed shortly thereafter. Of course, the strength of this cause-effect relationship can be disputed.

After the 1981-1982 recession (Point 2). While the 24-month values stayed elevated and even increased, we did not experience another recession (as defined by NBER).

Conclusion: it is interesting that the 24-month values have not dropped meaningfully after the end of the 2020 recession. While this alone does not mean we are due for another recession soon (double-dip), current macro themes do seem to echo the environment after the 1980 recession (Point 1 above): high inflation, with Federal Reserve interest rate hikes on the horizon. Hopefully they’ve learned a thing or two from the past!

Market-Based Inflation Probabilities

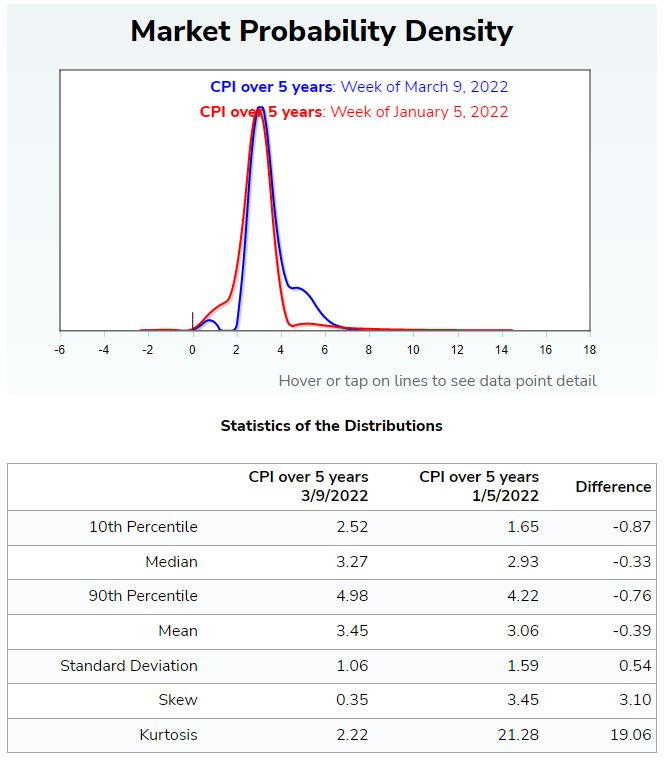

I’m sure many of you are familiar with how UST Inflation Breakevens can be interpreted as average future CPI inflation estimates. However, I recently learned of a tool published by the Federal Reserve Bank of Minneapolis that graphs probability densities for average CPI inflation over the next 5 years, using interest rate caps and floors.

This analysis suggests that average CPI over the next 5 years is expected to be 3.45% (annualized). However, note the large right tail (blue distribution), which wasn’t there earlier this year (red distribution). This suggests that many participants in the market for rate caps and floors think there is a lot of upside risk for CPI. Not too surprising, given current macro events.

This tool can be found here. It has been pretty buggy for me, so you might have to click a different link on that page and then click back to “Market-based Probabilities” for the tool to load properly.

Until Next Time

Terrence | terrencez.com

View previous updates in the archive.

I’m always eager to hear your comments or questions. Just hit reply to this email, and I will respond. You can also fill out the contact form here. Either way, I will respond via email.

All opinions are my own and not the views of my employer.